year

2022

No. of pages

51

Target group

Companies that have a maximum of 4 full-time employees (including the owner) and are involved in at least 3 building construction activities.

Key research topics

Profiling, purchase behaviour, product and brand scan among handymen

Methodology

Based on 1.562 successful quantitative telephone interviews in native languages

Country scope

Spain, Italy, France, the Netherlands, the UK, Germany, and Poland

Deliverables

Full report in pdf or ppt covering all 11, 10 or 8 countries, support from a key account manager in case of questions

Publication frequency

Annually

Price

8,400 Euro

What is this report?

This report offers a comprehensive overview of purchase behaviour, product, and brand scanning, with a specific focus on European handymen. Brand preferences are covered for each country, showing differences among spontaneous awareness, brand usage, and the most used brand, while the segment on purchase channels shows the type of buying behaviour and preferred channels handymen choose.

Within the report, you will discover the profiles of the handymen, their typical age span, what kind of companies they mostly work for, and in which kinds of construction projects they are typically involved. This information can assist you in refining, enhancing, or developing your business strategies targeted at handymen. Our research is based on quantitative telephone interviews conducted with 1.562 handymen, each representing firms with one or more employees, distributed across the 7 major European markets.

Why do you need this report?

Professional handymen are an important target group in building construction, but because they are part of such a broadly defined population, the professional handyman is hard to define and reach out to. As a result, professional handymen are a rarely researched target group, and very little is known about their business and behaviour. This monitor aims to solve that by profiling the professional handyman.

This report will provide key insights into handymen and their preferences in purchase channels, behaviour, and brand preference. Those details will be most beneficial to marketing departments, sales departments, and product development teams. These insights will be particularly valuable for manufacturers and wholesalers targeting this group, and with this information, they can optimize their business strategies. Furthermore, understanding handymen’s behaviour and preferences will facilitate fact-based internal discussions without the need for custom research.

How was the research conducted?

This report is based on 1.562 successful quantitative telephone interviews with handymen, conducted in their native language in Spain, Italy, France, the Netherlands, the UK, Germany, and Poland. The report is built upon a representative sample of handymen from companies with a maximum of 4 full-time employees (including the owner) who are involved in at least 3 building construction activities. This research is conducted annually, with the reports covering various key marketing topics.

What is included in this report?

The primary focus of this research is to provide key insights into trends in handyman purchase behaviour. The report examines handymen’s buying and professional behaviour and also delves into the most popular brands among handymen. It highlights key differences among the 7 European countries covered and provides detailed insights. The report also includes a detailed profile of handymen. If your target audience includes handymen, this report can help you develop a more precise strategy and sharpen your approach toward this group.

Key questions answered

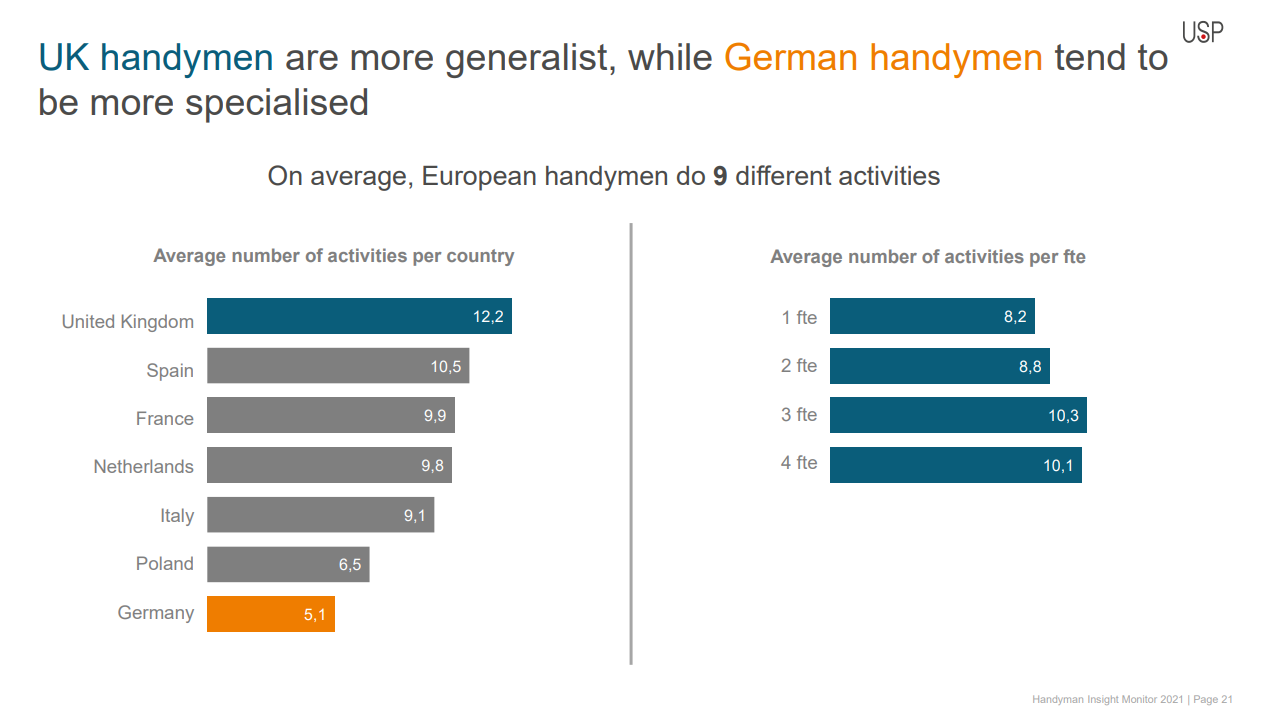

How many activities, on average, do handymen in Europe cover, and how does this vary by country?

In which countries are handyman jobs more expensive, and in which are they less expensive?

What is the yearly turnover of handymen in European countries?

Do handymen use the Internet, and do they consider it useful?

Is sustainability important to the clients of handymen?

In which kinds of activities are handymen most involved?

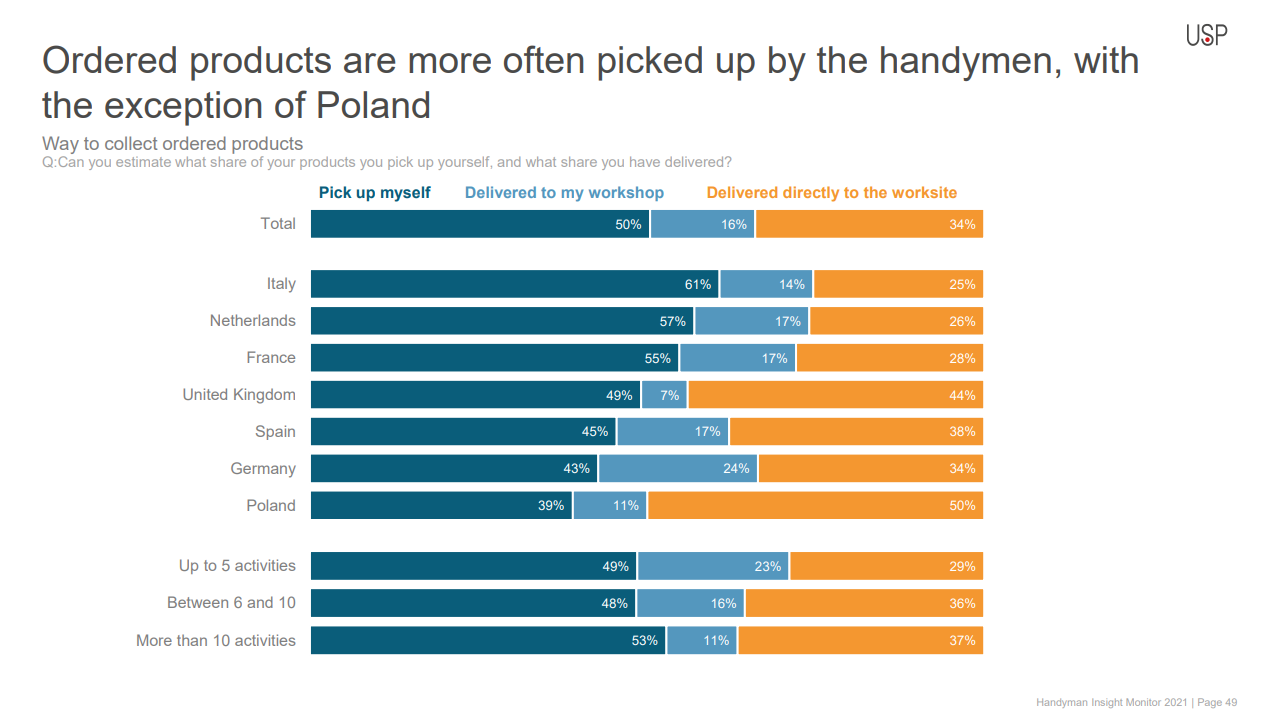

How many purchase channels do European handymen use?

Table of content

- Management summary

- Profile of the handymen

- Activities and product usage

- Purchase channels

- Brand funnels

- Ceramics

- Taps

- Fixings

- Sealants

- Insulation

- Gypsum

- Wall paints

- Floor coatings

- Facade sheets and sidings

- Adhesives

Frequently asked questions

-

How many different activities can European handymen do?

On average, European handymen engage in 9 different activities. UK handymen are more generalists, covering an average of 12.2 activities, while German handymen tend to be more specialized, averaging 5.1 activities.

-

What do European handymen think about their clients' knowledge of products?

Despite a high share of products being bought by clients, Polish handymen disagree that customers are well-informed about the products. In contrast, 83% of German handymen believe that their customers are well-informed.

-

How many purchase channels do European handymen use on average?

The more generalists the handymen are, the more varied purchase channels they use. In the UK and Spain, 28% of handymen use 7 or more purchase channels.

-

Is a one-stop-shop important for European handymen?

One-stop shopping is gaining importance in Italy and Poland, but less so in Germany.

-

Do handymen in Europe feel that they are taken seriously by professional channels?

Handymen generally feel that they are taken seriously by professional channels, especially in the Netherlands, where 72% of them think so.

Contact us

Send us a message

Please contact our office or fill in the contact form and our specialists will contact you.

PHONE

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam