year

2023

No. of pages

64

Target group

Painters from companies that indicate spending more than 10% of their working time on painting

Key research topics

Purchase behaviour among painters

Methodology

11-country report: Based on 1.905 successful quantitative telephone interviews in the native languages

10-country report: Based on 1.753 successful quantitative telephone interviews in the native languages

8-country report: Based on 1.453 successful quantitative telephone interviews in the native languages

Country scope

11-country report: The UK, Germany, The Netherlands, Belgium, France, Spain, Italy, Poland, Sweden, Denmark, Czech Republic

10-country report: The UK, Germany, The Netherlands, Belgium, France, Spain, Italy, Poland, Sweden, Denmark

8-country report: The UK, Germany, The Netherlands, Belgium, France, Spain, Italy, Poland

Deliverables

Full report in pdf or ppt covering all 11, 10 or 8 countries, support from a key account manager in case of questions

Publication frequency

Annually

Price

10,815 Euro

What is this report?

This report offers a comprehensive overview of purchase behaviour, with a specific focus on European painters. Within the report, you will discover not only the professional and buying behaviour of painters but also their attitude toward sustainability. Also, in the report, you will find brand funnels and information on the most preferred brands among painters in different categories. This information can assist you in refining, enhancing, or developing your business strategies targeting painters. Our research is based on quantitative telephone interviews with painters from companies that indicate spending more than 10% of their working time on painting. There are multiple options for this report: an 11-country report based on 1,905 successful quantitative telephone interviews in the native languages, a 10-country report based on 1,753 interviews, and an 8-country report based on 1,453 interviews in the native languages.

Why do you need this report?

This report is crucial for understanding the purchasing behaviour of painters in the conservative paint market, including their loyalty to certain brands and their channel preferences for purchasing products. It also sets brand funnels and examines which brands are the most preferable among professional painters in different categories. By understanding these dynamics, stakeholders in the paint industry can adapt their strategies to meet the evolving needs of professional painters. This report will provide key insights into painters and their professional behaviour and will be most beneficial to marketing departments, sales departments, and product development teams. These insights will be particularly valuable for manufacturers and wholesalers targeting this group, and with this information, they can optimize their business strategies. Furthermore, understanding painters’ behaviour and preferences will facilitate fact-based internal discussions without the need for custom research.

How was the research conducted?

This report is based on successful quantitative telephone interviews with painters conducted in their native language. The number of interviews depends on the number of countries investigated in the report. There are three research options available: the 11-country report is based on 1,905 interviews, the 10-country report is based on 1,753 interviews, and the 8-country report is based on 1,453 successful interviews. The report is built upon a representative sample of painters from companies that indicate spending more than 10% of their working time on painting. On average, interviewed companies spend 79% of their time on painting. This research is conducted annually, with the reports covering various key marketing topics.

What is included in this report?

The main objective of this research is to offer valuable insights into trends in the behaviour of painters. The report investigates painters’ purchasing behaviour, including their favoured channels, most frequently ordered products, and preferred brands. It also emphasizes distinctions among the European countries under consideration while providing comprehensive and in-depth insights to inform strategic decision-making. The report also provides a detailed profile of painters and offers insights into painter companies in Europe, including their pain points. If your target audience includes painters, this report can assist you in developing a more precise strategy and refining your approach towards this group.

Key questions answered

What is the average age of European painters?

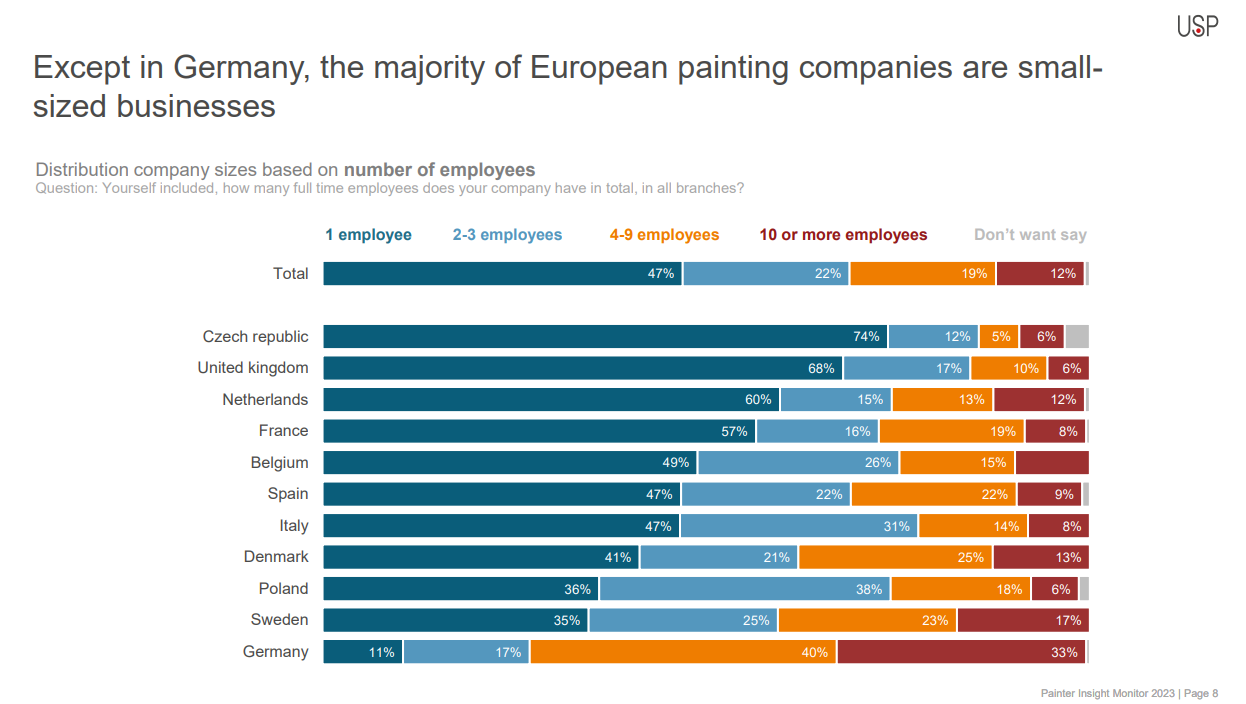

Which type of painting company, by size, can be found in Europe the most?

What is the attitude of European painters toward the Internet?

In which type of jobs are the painters the most involved in?

What do painters forecast in terms of painters’ job amounts in the next year?

In which countries is the labour shortage the most alarming among painters?

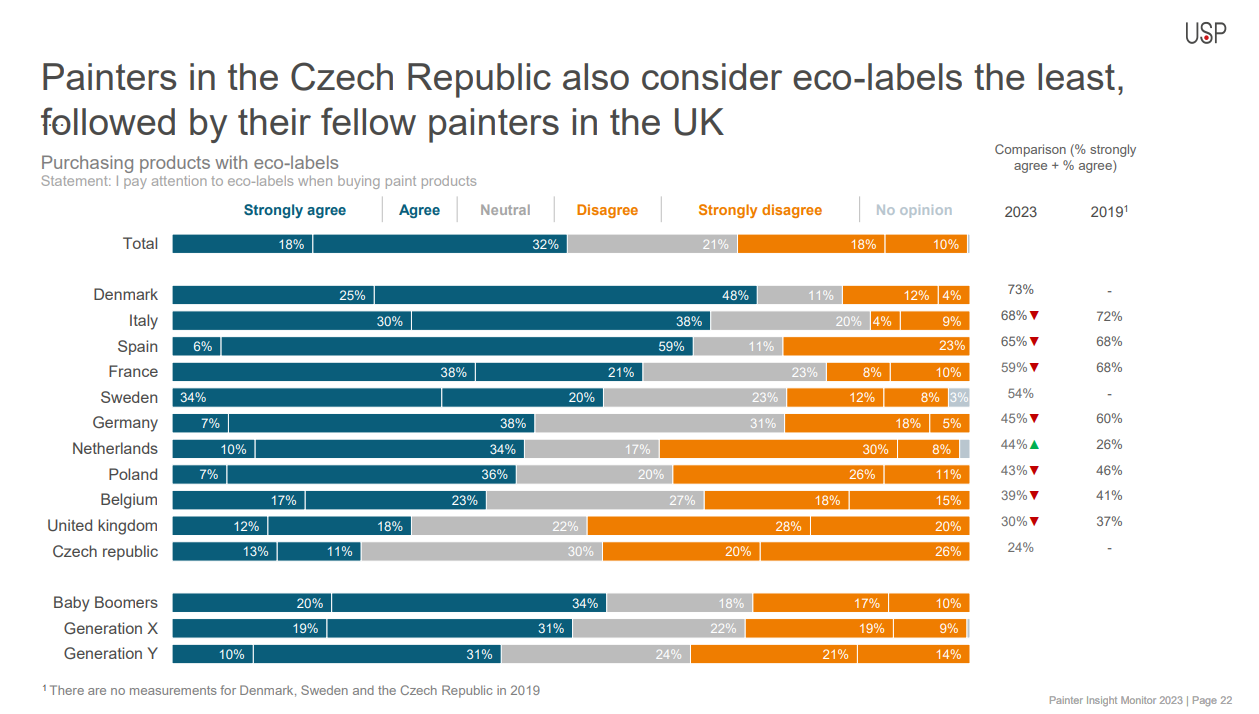

What is the painters’ attitude toward sustainability?

How important is the preferred brand to European painters?

Are painters willing to buy online?

Which colours are purchased the most among European painters?

What is the most used way for painters to order products?

Table of content

- Management summary

- Profile of the Painter

- Sustainability

- Product usage and online buying behaviour

- Paint products

- Consumables

- Power tools

Frequently asked questions

-

What is European painters' most common purchase channel when buying power tools?

Painters mostly buy their power tools from manufacturers; specialized wholesalers and general wholesalers are the most common.

-

How do painters in Europe order their consumables the most?

Painters order consumables in traditional ways and rarely online, in person, via phone, or via email.

-

What are the main decision criteria when painters are buying wall paint?

When buying interior wall paint products, quality comes before the price for the majority of European painters. 80% stated that that is the most important criterion, but price should not be ignored; among 50% of painters, pain plays an important role in buying decisions.

-

What is the most popular wall paint colour among European painters?

After white, the grey colour family is the second most popular colour family in the majority of countries, with 60% of painters preferring that colour.

-

How much is the preferred brand important to European painters, and are they willing to compromise if that brand is not available in the store?

The majority of painters (55%) do not give up on a preferred brand for their preferred store.

-

In which countries is the labour shortage the most alarming when it comes to European painters?

The labour shortage issue remains at an alarming level, mostly in Germany and the Netherlands.

Contact us

Send us a message

Please contact our office or fill in the contact form and our specialists will contact you.

PHONE

+31 10 2066900ADDRESS

Max Euwelaan 51

3062 MA Rotterdam