Market report

BIM usage among installers

Gain valuable insights into the European mechanical installation monitor market with the latest market report from USP Research. Stay informed on industry trends and opportunities.

News I published 12 July 2022 I Dirk Hoogenboom

Who are the BIM-using installers?

As part of the overall trend of digitalisation of the construction process, Building Information Modelling (BIM) plays an increasingly important role in the European construction sector. Over the past decade, we have seen BIM usage among architects increase slowly but steadily, and in 2021, 44% of European architects were already using BIM in projects.

Among professionals who are involved in later stages of the building construction process, BIM usage is still rather low. BIM usage among European HVAC installers is still under 10% on average, for instance. As we saw in a previous article, however, BIM usage is expected to grow slowly but steadily among installers as well. In some cases, BIM usage is already much higher, like in the Netherlands where nearly a quarter of installation companies already use BIM.

To get a clearer idea of future BIM adoption, it pays to know more about the installation companies that are already using it. Who are these installers who invested money, effort and time to start using BIM? To find out, we interviewed HVAC installers from six major European markets on their experience with BIM for USP Marketing Consultancy’s European Mechanical Installation Monitor.

Current BIM users are predominantly large installation companies

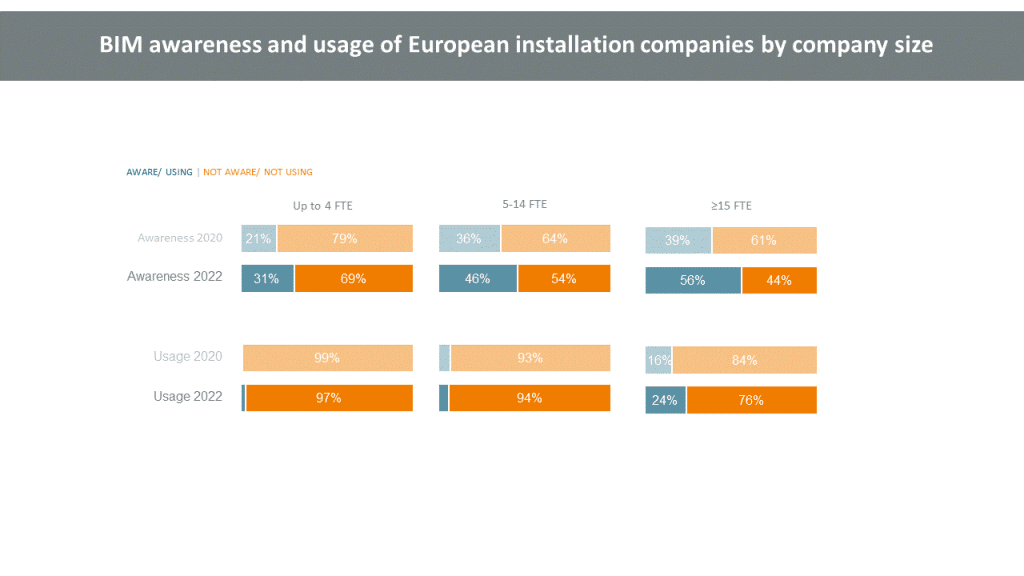

Looking at the size of installation companies, BIM usage is almost non-existent among the smallest, as only 3% of installation companies with a size of 4FTE or less report to use it. The share of users is larger among medium-sized installation companies, but still only a fraction (6% among installation companies sized 5-14FTE).

The real BIM action is found among the larger installation companies (15FTE or more), of which BIM usage has grown from 16% in 2020 to almost a quarter in 2022. For these larger companies, the investment necessary to acquire BIM software and train or hire a BIM specialist may be more feasible, but there are other reasons why current BIM users are mainly the large installation companies.

BIM users are more involved in new-build and non-residential projects

On average, the BIM-using installation companies are getting 57% of their turnover from new-build projects, whereas installation companies that are not working with BIM are more involved in renovation. Also, BIM-using installers get about half of their turnover from non-residential projects, whereas non-BIM-users get 61% of their turnover from residential projects.

It makes sense that BIM is already used a lot more in large-scale non-residential new-build projects, than in smaller residential and renovation projects. Larger installation companies are more often involved in those large non-residential new-build projects. That means that, aside from having the necessary means to invest, the larger companies have more of an incentive to adopt BIM as well.

Future of BIM usage among HVAC installers

The above also explains why BIM usage is not exploding but only steadily growing. BIM is mainly used for larger non-residential projects, which are done by larger installation companies. The smaller installation companies, for whom starting with BIM is rather expensive and offers less reward in their smaller residential or renovation projects, are a lot more numerous than the larger installers.

That does not mean that more growth of BIM usage among HVAC installers is impossible though. BIM will increasingly be a requirement for projects, and usage among architects and contractors is already substantial and ever growing. Our expectation is that BIM usage will continue to grow among large installation companies, and that the group of medium-sized installation companies (5-14FTE) will slowly be drawn into BIM usage as well. For more information on the role of BIM in the projects of HVAC installers in six major European markets, we refer you to the Q1 report of USP Marketing Consultancy’s European Mechanical Installation Monitor.