Market report

Do-it-for-me in Home Improvement market

Access the latest market reports on European home improvement trends and insights at USP Research. Stay informed on the latest industry data and analysis.

News I published 07 March 2024 I Reinier Zuydgeest

Do-it-for-me becoming more popular in the European home improvement market

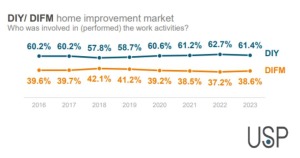

In our most recent report of the European home improvement monitor (Q4 2023 DIY vs DIFM), a notable shift in consumer behaviour towards the preference for professional services, termed as the “do it for me” trend, which is gaining momentum despite certain demographic and economic challenges.

Traditionally, the do-it-yourself (DIY) approach has been a prevalent choice among homeowners, driven by factors such as cost-saving measures and personal satisfaction in tackling home projects independently. However, recent observations indicate a departure from this trend, marked by an increasing inclination towards seeking professional assistance for home improvement endeavors.

One prominent factor contributing to this shift is the aging population. Contrary to expectations, older generations have displayed a remarkable resilience in continuing to engage in DIY activities. Nonetheless, as individuals advance in age, physical limitations may render them unable to undertake certain tasks independently, necessitating the involvement of skilled professionals. Consequently, the older demographic segment has emerged as a significant catalyst for the rise of the “do it for me” ethos.

The year 2023 witnessed a pivotal moment in this evolving narrative, with statistics indicating a notable decrease in the share of DIY projects in the total job mix compared to previous years. The proportion of DIY projects declined from 62.7% in 2022 to 61.4% in 2023, while the share of “do it for me” experienced a corresponding increase, rising from 37.2% to 38.6%. This reversal marks the first time since 2019 that the trend towards professional services has shown a tangible upward trajectory.

Several factors underpin this resurgence of the “do it for me” mindset. The aging demographic is a primary driver, as individuals recognize the practical necessity of outsourcing tasks that surpass their physical capabilities. Additionally, the aftermath of the COVID-19 pandemic has reshaped consumer behaviours, prompting a surge in DIY efforts, particularly in minor decorative projects. As consumers gradually exhaust these smaller tasks, attention is shifting towards more extensive and intricate home renovations, a domain where professional expertise is often indispensable.

Moreover, there is a discernible trend towards enhancing the sustainability of residential properties. Whether through passive measures such as improved insulation or active interventions like upgrading installations, the pursuit of sustainability is increasingly becoming a priority for homeowners. Such endeavors typically necessitate specialized knowledge and technical proficiency, leading homeowners to enlist the services of professionals.

Despite the burgeoning demand for professional services, the construction and installation sector in Europe faces a formidable challenge in the form of labor shortages. This scarcity of skilled workers poses a significant constraint on the pace of transition towards the “do it for me” paradigm. As labor costs escalate due to the imbalance between supply and demand, the anticipated shift may unfold gradually, with potential reversals prompted by economic dynamics.

In conclusion, the evolving dynamics of home improvement underscore a nuanced interplay between demographic shifts, consumer preferences, and market realities. While the ascent of the “do it for me” trend signals a departure from last years where the share of DIY in the total job mix was increasing, its trajectory is tempered by practical considerations and economic constraints.

Home Improvement Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.