Market report

Share of wallet in installation industry

Stay informed about the European electrical installation monitor with the latest market reports provided by USP Research. Browse through detailed analysis and insights on the electrical industry.

News I published 05 February 2024 I Dirk Hoogenboom

Electrical installers only spend a small share of wallet at pure online players

The European electrical installation market has long been characterized by traditional purchase behavior among installers. For decades, a three-step market approach has prevailed, with wholesalers holding a significant role in the distribution process.

That being said, in recent years, there has been a noticeable increase in direct supply from manufacturers, marking a departure from the reliance solely on wholesale channels. However, when looking at pure online channels, like for example Amazon or local specialised pure online stores, they remain largely underutilized, accounting for only a marginal share of installer purchases across Europe.

In our latest Q4 2023 report of the European electrical installation monitor on purchase channels, we report that 30% of electrical installers in Europe utilize pure online stores, albeit predominantly for small-scale purchases. Notably, installers in the UK and Poland lead in the proportion of share of wallet allocated to pure online shops, though the overall share remains relatively low at 8% and 9% of their total purchases, respectively. Product category plays a significant role in online purchasing behaviour, with power tools emerging as the most frequently bought items through online channels.

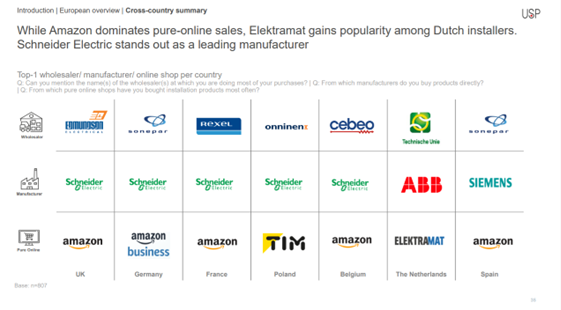

Amazon emerges as the dominant player in the pure online landscape, with its business platform being the preferred choice for most installers across various European markets, when they use a pure online channel. Looking towards the future, it is anticipated that the share of installers purchasing from pure online players will gradually rise. However, despite this upward trajectory, the overall share of wallet allocated to online channels is expected to remain modest.

The preference for traditional channels, such as specialized wholesalers and direct supply via manufacturers, persists among the majority of installers. This loyalty is underpinned by the growing nature of the market and the absence of compelling incentives for installers to explore alternative purchasing avenues. With ample work opportunities and a thriving market, installers are content with their current procurement methods.

It is speculated that a shift towards a higher share of wallet at pure online stores may occur in the event of market stagnation or decline. However, given the optimistic outlook of the market, such a scenario seems unlikely in the foreseeable future.

Installation Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.