Market report

Private labels vs. Branded products

European consumer opinion on private label home improvement products continues to rise! USP Research reports a positive shift, with younger demographics leading the way.

News I published 15 January 2024 I Reinier Zuydgeest

Consumers continue to have a more positive opinion about private labels for home improvement products

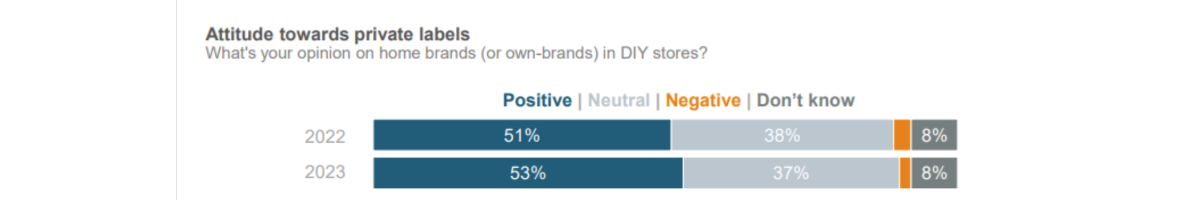

For many years, the attitude of consumers towards private labels for home improvement products has been tracked by our European home improvement monitor. In our Q3 2023 report on branding, we reported a further increase in the positive opinion of consumers towards private labels for home improvement products. In 2022, about 51% of European consumers had a positive opinion of private labels for home improvement products. This will increase to 53% in 2023. In contrast, the share of consumers with a negative opinion about private labels decreased from 8% in 2022 to 3% in 2023.

Delving deeper into consumer attitudes reveals an interesting generational pattern. The younger demographic, often grappling with tighter budgets, exhibits a more positive outlook towards private labels. In the age group 18–34, 57% of consumers have a positive opinion of private labels for home improvement products, versus 50% for the 55+ age group. This affinity is likely correlated with their relatively lower income levels, positioning private labels as a practical and economical choice for home improvement needs.

One of the key reasons why consumers have a more positive opinion about private labels is that the quality of the products has increased significantly over the years. Furthermore, DIY stores have been more actively promoting private labels and have invested more in product development to ensure that private labels are a viable alternative to A brands. This also follows the trend where product differentiation becomes more difficult and branding becomes more important.

It’s important to note that a more positive opinion towards private labels doesn’t necessarily mean that consumers are shifting in mass towards buying and using private labels. That being said, the continued positive opinion of European consumers towards private labels for home improvement products indicates that the potential for private labels will continue to grow in the future.

The insights you are reading have been extracted from the European Home Improvement Monitor, a quarterly research publication through which we regularly assess the state of the home improvement market. This research represents the opinions of consumers from 11 European countries. Each report tracks the number of jobs being done, the amount spent, and key trends shaping the market, including e-commerce, the shift from DIY to DIFM, orientation behaviour, sustainability, branding, and more.

You can also explore our latest editions of the European Home Improvement Monitor here.

Home Improvement Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.