Market report

Prefab trends in Construction industry

Explore comprehensive market reports on contractors at USP Research. Stay informed about industry trends and insights to make data-driven decisions for your business.

News I published 11 October 2024 I Dirk Hoogenboom

Rethinking European Construction: Prefab Trends

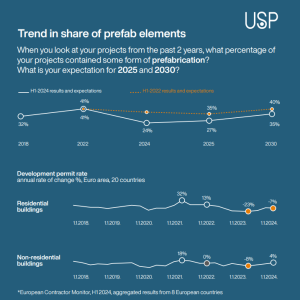

What does the future hold for prefabrication in the construction industry and how are European contractors adapting to the market shifts? These are focus points raised by our latest report, the European Contractor Monitor (Prefab H1-2024). This research – done twice a year and based on insights from larger contractors involved in significant commercial projects – goes into the key trends in the current landscape and potential future of prefabrication.

A Dip in Prefabrication

In 2022, prefabrication made up a healthy 41% of construction projects across residential and non-residential sectors. Fast forward to 2024, and that share has dropped to 24%. What’s driving this decline? Several factors:

New Build Pressure

Many European countries are experiencing a slowdown in new construction, and prefab is still very much a new construction game. So when new build accounted for 60-70% of the work, things looked promising. Now, the market is changing, and with renovation taking over, prefab is taking a proportional step back. And as long as it remains tied to new build, we will continue to see lower numbers.

Sustainability Needs

A growing emphasis on sustainability means existing buildings need retrofitting to meet modern standards. While this creates potential for prefabrication’s comeback, it hasn’t quite happened as of yet. As contractors continue to focus on green practices, we might again see prefab solutions gaining traction.

Geopolitical Challenges

The ongoing war in Ukraine and other geopolitical tensions have resulted in fewer construction projects. These instabilities create significant disruptions in the supply chain, in material costs, labor shortages, so companies reassess their project pipelines. The focus has shifted towards risk mitigation rather than expansion, stalling the adoption of advanced construction methods, including prefabrication.

Market Uncertainty

All this translates to – uncertainty. And when the market is in flux, contractors tend to stick to traditional projects and familiar methods. As companies grapple with the unknowns, the focus shifts towards minimizing risk and ensuring stability. Consequently, investment in new technologies and processes often takes a backseat, stifling progress and limiting the potential for growth in the sector. Despite these hurdles, there’s hope that as the market stabilizes and new builds begin to rise again, prefabrication will follow suit.

Architects Share the Same Story

Looking at architect stats, we are seeing a fairly similar trend, with a noticeable decline in prefabricated projects. After a peak in 2021, the numbers dropped in 2023 across various European countries. Some regions feel this shift more acutely than others, but overall, the industry is showing signs of resilience and adaptability.

Looking Ahead

So, what’s next for prefabrication in the construction industry? While the current statistics may seem concerning, they don’t capture the full picture. There is significant potential for growth in prefab, especially as sustainability takes center stage and the market begins to stabilize. With adaptability and innovation, we will soon see a renewed embrace of prefab in construction, leading to more efficient and sustainable building practices.

Want to learn more about the future of prefabrication? Download our latest report, “European Contractor Monitor (Prefab H1-2024),” for in-depth insights and analysis.

Construction Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.