Market report

Branding in Home Improvement Market

Gain valuable insights into the European home improvement market with USP Research's European Home Improvement Monitor report. Discover trends, statistics, and analysis to inform your business decisions.

News I published 21 April 2022 I Dirk Hoogenboom

Outsourced home improvement jobs may change brands’ playing field

For years, the share of home improvement jobs being outsourced was growing, while the share of jobs done by homeowners themselves was declining. As we saw in a previous article, that trend of Do It Yourself (DIY) versus Do It For Me (DIFM)turned around after 2018. Since then, DIY is on the rise again, leading to more than 60% of European home improvement jobs being done by consumers themselves in 2021.

Be that as it may, this still means that about four out of ten home improvement jobs are outsourced to other parties. These other parties may have an influence on product usage and purchase, which is why it is essential for manufacturers and brands of home improvement products to know who these other parties are. For the Q4 2021 report of USP Marketing Consultancy’s European Home Improvement Monitor, we asked 6.800 consumers from 11 countries to whom they outsourced their home improvement jobs.

Most DIFM jobs are outsourced to specialised companies

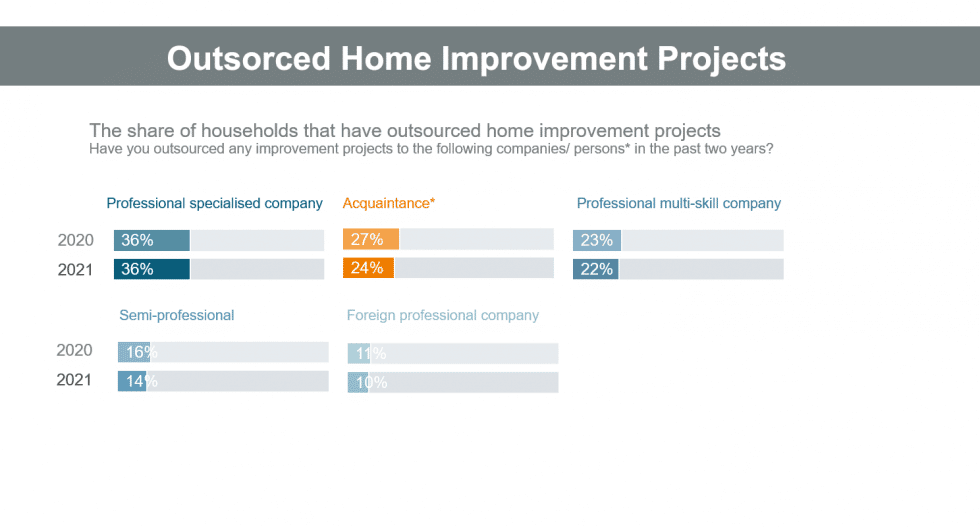

As the graph shows, about a quarter of European consumers reported that they outsourced a home improvement job to an acquaintance. Meanwhile, 36% reported that they outsourced to a professional specialised company, while 22% outsourced to professional multi-skill companies or handymen. 18% outsourced to semi-professionals and 10% to foreign professional companies.

Clearly, a vast share of outsourced home improvement jobs is outsourced to professionals. These professionals may influence the process, including decisions on products, brands, and points of purchase. For instance, in the recently published European Handyman monitor, we saw that professional multi-skill companies mainly work for private homeowners and report that they have purchasing power in more than half of their projects.

Professionals use different purchase channels

When professionals hired to do home improvement jobs have purchasing power, they will probably use their familiar and favourite purchasing channels. Depending on the specialisation of the professional and the type of home improvement job, these professional channels will range from general building material wholesalers to specialised wholesalers or even purchasing directly from the manufacturer.

This means that brands of home improvement products that naturally rely on purchase channels used by consumers may miss out when home improvement jobs are outsourced to professionals. Even though the share of DIFM may be declining, the above shows that the share of home improvement jobs outsourced to professionals is quite vast.

These are European averages, though. Shares of home improvement jobs being outsourced differ significantly when zooming in on the countries we covered in this research. Likewise, the types of home improvement jobs and the parties they are outsourced to differ from country to country. For a full overview of consumers’ DIY and DIFM behaviour, including the types of professionals they outsource home improvement jobs to in 11 countries, we refer you to the Q4 2021 report of USP Marketing Consultancy’s European Home Improvement Monitor.