Market report

Private labels vs. Branded products

Get valuable insights on the handyman market from USP Research. Visit their website for detailed market reports and analysis on the latest trends in the handyman industry.

News I published 12 December 2024 I Henri Busker

Handymen Radar – Private Labels vs. Branded Products

Each year, the European Handyman Insights Monitor takes a close look at what matters most to handymen across Europe. With the industry facing a rising demand for versatile, skilled workers who can tackle everything from small household projects to larger repair jobs, understanding their preferences is more relevant than ever. For 2024, we’re focusing on the competition between private labels and branded products.

Quality, reliability and after-sales support remain key priorities, especially in a sector where durability and performance are paramount. Yet, opinions on private labels vary considerably depending on the country, age group and type of handyman. Overall, only 16% of handymen will be using private labels in the following three years, with stronger preferences showing up in Italy (19%), the UK (21%) and Poland (22%).

The rest are either neutral or disagree, meaning private labels may have made some inroads, but branded products will continue to be the go-to choice for most.

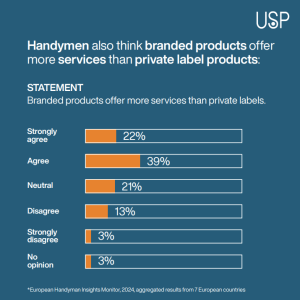

Branded products are seen as better-quality products than private label products are, especially among Polish and French professionals (30% and 24% respectively). Across the board, handymen also believe branded options come with added services (22%), extended warranties (20%), a technical edge (20%) and more innovation (20%) compared to private label products, though there are some differences.

Dutch handymen, for instance, are less focused on brands’ technical superiority, while handymen in the UK are less outspoken about the innovative edge brands offer.

Age also plays a role in these preferences: baby boomers and Gen-X overwhelmingly prefer branded products, valuing the perceived quality and support, while Gen-Y handymen are slightly more open to private labels, though a majority still favor branded products.

Lastly, there is little difference between multiskilled handymen and specialists in their product preferences. Both groups lean towards branded products, with specialists slightly more likely to value the innovative and technical advantages that branded products offer.

Overall, while private labels have carved out a small niche, the 2024 report underscores a clear message for suppliers: maintain quality to stay ahead.

Construction Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.