Market report

Private labels vs. Branded products

Visit the USP Research website for in-depth market reports and analysis on the European home improvement industry. Gain valuable insights to make informed decisions in this growing market.

News I published 17 January 2024 I Dirk Hoogenboom

European consumers are almost evenly split in their preferences for private labels vs A-Brands for home improvement products

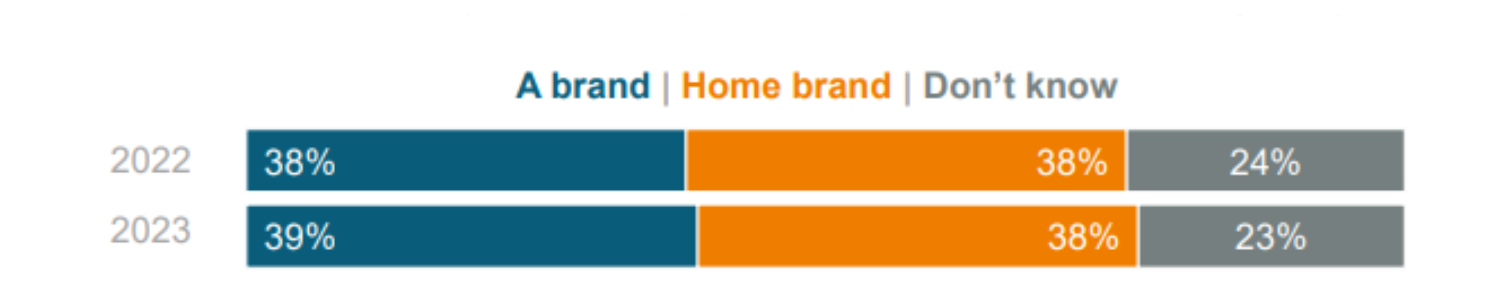

In our Q3 2023 report of the European home improvement monitor, we measured the preference of European consumers when it comes to private labels vs A-brands for DIY products. Interestingly, the preferences of consumers is almost evenly divided with 39% preferring an A-Brand versus 38% preferring an private label. This didn’t change much compared to 2022 (38% vs 38%).

When looking at differences between various age groups, it’s clear that the younger generation, aged 18 till 34, have a higher preference for A-brands (42%) then older generation, aged 55+ (35%).

Furthermore, there are major differences between the various home improvement product groups. The product groups where on average European consumers have the highest preference for A-brands are boilers (55%), paint (51%) and locks (49%).

On the other hand, the preference for private labels is the highest for brushes & rollers (59%), masking tapes (56%) and duct tape (55%).

Overall, the preferences of European consumers remain relatively stable. In the same report, we also asked about the attitude towards private labels. On this aspect, we do see a stronger development towards a more positive attitude towards private labels. The interesting conclusion could be that a more positive attitude towards private labels, doesn’t directly translate towards a stronger preference (yet). This also points to the importance of branding in the home improvement market.

The insights you are reading have been extracted from the European Home Improvement Monitor, a quarterly research publication through which we regularly assess the state of the home improvement market. This research represents the opinions of consumers from 11 European countries. Each report tracks the number of jobs being done, the amount spent, and key trends shaping the market, including e-commerce, the shift from DIY to DIFM, orientation behaviour, sustainability, branding, and more.

You can also explore our latest editions of the European Home Improvement Monitor here.

Home Improvement Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.