Market report

Sustainability in installation industry

Discover the latest market trends and insights in the European electrical installation monitoring industry with USP Research's detailed market report. Explore key data and analysis to stay informed.

News I published 06 June 2024 I Maja Markovic

Sustainability in the electrical installation sector; slow but steady growth

The construction and installation sectors are closely intertwined with sustainability topics. Over the past decade, numerous initiatives have aimed to foster industry support for sustainable development agendas. Installation systems play a vital role in creating sustainable buildings and reducing CO2 emissions.

In recent years, the HVAC side of the installation segment has received most attention, at least in the media and due to the gas and oil crisis following the war in Ukraine. But what about the electrical side of the installation segment? This is the core topic of our latest Q1 2024 report of the European electrical installation monitor on sustainability.

Slower but more sustained growth

In the last years, the electrical installation market has seen an uptick in the share of projects where sustainability played a role. However, generally speaking it can be categorised as a steady and sustained growth (not in all countries, more on that later). Especially in comparison with the boom of sustainable solutions in the HVAC market or recent years (for example the explosive heat pump growth).

But whereas we see a sudden slump in heat pump sales, and even in projects that involve sustainable solutions in the HVAC sector, the electrical installers report that the steady growth of recent years will continue.

Country differences

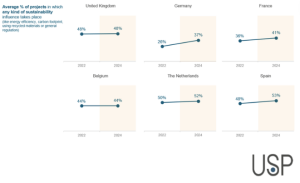

When looking at the share of projects in which sustainability place a role and compare this with the previous measurements in 2022, a moderate increase is reported by the electricians in the Netherlands, Spain and France in 2024.

German installers report a very high increase in the share of projects where sustainability place a role. However, it’s worth noting that the share of projects where sustainability plays a role was the lowest in Germany in 2022 and still is, despite the strong growth, in 2024.

In Belgium and the UK there was no to minimal growth reported between 2022 and 2024.

LED lighting and PV are in the highest demand

One of the key reasons for slow down of sustainability improvements in the HVAC sector have to do with, besides a drop in the sense of urgency, the high costs. Both material and labour cost increased significantly and the interest rates remain on a relatively high level. This means the willingness to invest is lower. Also we need to consider that the majority of the growth came from early adopters and now the early majority needs to buy in, who typically have less financial means or less suited houses/buildings.

It’s no surprise then that in the Electrical installation sector, where these considerations also play a role, a low cost sustainably solutions takes the spot for most used sustainable solution/product. We are talking here about LED lighting. A strong number two are PV panels. Other solutions, ranging from battery storage to EV and energy management solutions score significantly lower. Again, we need to consider that there are clear differences between the countries, not so much for the top 2, but for the solutions that come after that.

Knowledge of material passports and EPD still low

The familiarity of installers with terms like material passport and Environmental Product Declarations remains low, suggesting these concepts have minimal influence on their decision-making processes.

The highest familiarity with EPD’s can be found in the UK, but still only 28% was familiar with the term. Of that 28%, 40% takes EPD’s into consideration in the selection of products.

The highest familiarity with material passports can be found in the Netherlands, where approximate 30% is familiar with the term.

More insights

These are just some insights from the Q1 2024 European Electrical Installation monitor on sustainability. This report, based on quantitative telephone interviews with electrical installers in 6 countries, covers much more. For example, the report covers (on a country level), the perception of sustainability, the willingness to pay (end customers and business customers), perception and most used installation products and much more. The full report is now available for 3,150 Euro.

In case of any questions, feel free to contact us.

Installation Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.