Market report

BIM usage among HVAC installers

Get valuable insights into the European mechanical installation monitor market with USP Research's market report. Learn about trends, growth opportunities, and key players in the HVAC industry.

News I published 02 July 2024 I Dirk Hoogenboom

BIM adoption among European HVAC installers remains low

In a continuously more digital world, the construction and installation industry is much slower to adapt than other industries. The nature of the industry (conservative) and the way we build (still a large share is traditionally built and renovation is a large part of the construction industry) slows down the adoption rate.

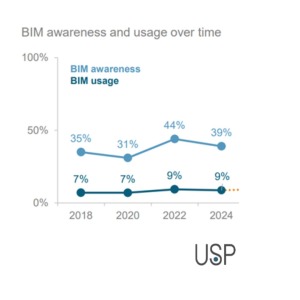

When discussing digitalization in the construction industry, BIM (building information modeling) is an important indicator. So to what extent are HVAC installers using BIM? And how did this develop over time? These, and many other questions, are answered in our latest Q1 2024 report from the European mechanical installation monitor on BIM.

BIM adoption remains low

One of the key findings of the report is that BIM adoption remains on the low side among European mechanical installers. On a European level, the share of installers using BIM is relatively low at 9%. However, there are significant country differences, with installers in the Netherlands using BIM much more often. About 22% of Dutch mechanical installers are BIM users. Furthermore, BIM usage is strongly correlating with company size. On a European level, only 3% of small installers (up to 4 employees) use BIM. The biggest companies use BIM much more often, with 22% being BIM users (15 employees and more).

Adoption speed is slow

If we look at the evolution of BIM usage among mechanical installers, it’s a very slow process. On a European level, in 2018 7% of all installers used BIM. This increased to 9% in 2024. For comparison, if we look at architects, BIM usage in 2017 was already 30% and it increased to 45% in 2023. There are some key differences between these target groups of course. Architects focus more on new build and are thus confronted with BIM more often. On top of that, they do a lot more ‘designing’ than the average installers.

Future outlooks

Even though the adoption speed and current usage are low, for bigger installers active in bigger new build projects, BIM is already a license to operate. And as we expect new build volumes to increase again towards the end of 2024-beginning of 2025 more usage amongst the bigger installers is expected. Also, mid-sized installers will be confronted with BIM more often, as the technology develops, becomes easier to use and cheaper to use. Only amongst the smaller installers, we don’t expect to see an increase in BIM usage.

What else is in the report?

In the full Q1 2024 report of the European mechanical installation monitor report, many more BIM-related topics are covered, like the LOD, support needs, features used, and many more. If you are interested in learning more, feel free to contact us or take a look at the Q1 2024 European installation monitor BIM report page.

Installation Consulting Services for You

We provide tailor-made market research and off-the-shelf reports, both B2B & B2C, qualitative and quantitative. Here are some you might be interested in

Monitor and improve client relationships to drive loyalty and repeat business in construction.

Map out key interactions and pain points to refine the overall construction experience.

Identify the aspects of service or product that most impact satisfaction in construction projects.